February 1, 2024

Mortgage rate trends might not be the most fun thing to think about.

But for people looking to buy a home, it is important to understand mortgage rate movements, and whether mortgage rates will go up or down.

Your mortgage rate determines the amount of interest you will have to pay back to your mortgage lender, in addition to paying back the amount you borrowed to purchase the property.

Lower mortgage rates mean you have less to pay back overall, and usually lower your monthly repayments, too.

There are a few factors affecting your mortgage rate which are (somewhat) within your control: Your credit score, the size of your deposit, and the length of your mortgage.

However, mortgage rates fluctuate on a national level, too. Mortgage rates in the UK can be influenced by factors such as inflation, Bank of England policies, and global market conditions.

How to gauge mortgage rates in the UK

While it is possible to make informed predictions, nothing is guaranteed. It is best to look at the factors yourself and speak to a mortgage advisor to get a better understanding of whether it looks as though mortgage rates will go up or down in 2024.

In the UK there are several economic indicators and market factors affecting mortgage rates that you should take into consideration.

Economic indicators that impact mortgage rates

How inflation impacts mortgage rates

Inflation reduces the general buying power of money. Though inflation may not directly affect interest rates, lenders use the Bank of England base rate as a basis for their mortgage rates. As the Bank of England’s base rate is partially based on inflation, mortgage rates are likely to fluctuate in line with inflation, so higher interest rates can mean higher mortgage rates.

Employment rates

National rates of unemployment (and subsequent repossessions due to defaulted mortgages) can impact overall mortgage rates. As unemployment rises, mortgage lending becomes more risky for banks — often resulting in higher mortgage rates.

GDP growth

Conversely, as the economy grows stronger and GDP rises, mortgage rates tend to rise too. As more people become financially able to qualify for a mortgage, mortgage rates (and therefore affordability) go up, as lenders have a finite amount of money so they need to control supply and demand.

External factors that impact mortgage rates

Bank of England policies

The Bank of England reviews and sets out the base rate of interest every six weeks. These base rates affect mortgage rates, as lenders use them to calculate their basic rate of interest.

Global market conditions

Of course, the Bank of England doesn’t operate in a vacuum. The Bank of England base rate is impacted by other central banks, meaning that financial market conditions worldwide can impact UK mortgage rates.

Geopolitical events.

Equally, geopolitical events can impact global market conditions, having a potential knock-on effect on Bank of England interest rates and UK mortgage rates.

Expert Forecasts and Industry Insights

As you can see, mortgage rates in the UK are hard to predict, as they are dependent on so many different factors. Let’s look to the experts for 2024 mortgage rate predictions:

The Financial Times recently reported that mortgage brokers are predicting a drop in mortgage rates in 2024 — potentially even reaching under 3% by the end of the year.

Aaron Strutt, of mortgage broker Trinity Financial (as reported on MoneySavingExpert in January 2024), also said that there is “a strong expectation that rates will come down” in 2024.

Both of these predictions are seemingly based on forecasts that Bank of England interest rates are set to fall this year, coupled with HSBC’s recent mortgage rate cuts (an example that other major lenders have followed).

Current Market Conditions and Historical Trends

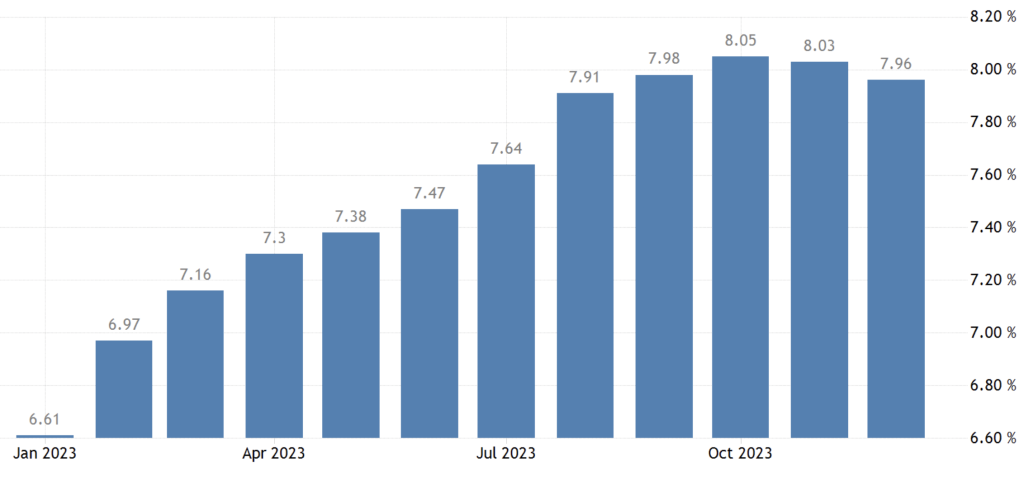

Until 2021, UK mortgage rates had been steadily declining since the highs of the 2008 crash.

These two highs (2008 and 2021) both coincide with financial recessions in the UK, and it could be fair to predict that, like in the years post-2008, mortgage rates may begin to steadily fall in the years post-2021.

Considerations for Homebuyers

If mortgage rates continue to fall, as predicted, first-time buyers and other homebuyers (and remortgagers) may be able to fix a lower mortgage rate towards the end of the year. However, it is worth bearing in mind that mortgage rates — like the housing market in general — are notoriously hard to predict. It’s always best to use your judgement alongside consulting with a qualified mortgage advisor when making financial decisions.